Reliable GA Hard Money Lenders: Your Solution for Quick Property Funding

Reliable GA Hard Money Lenders: Your Solution for Quick Property Funding

Blog Article

The Ultimate Overview to Finding the very best Tough Money Lenders

From evaluating lenders' reputations to contrasting passion prices and fees, each action plays a crucial role in securing the best terms possible. As you consider these variables, it becomes apparent that the path to recognizing the appropriate hard money lending institution is not as straightforward as it might seem.

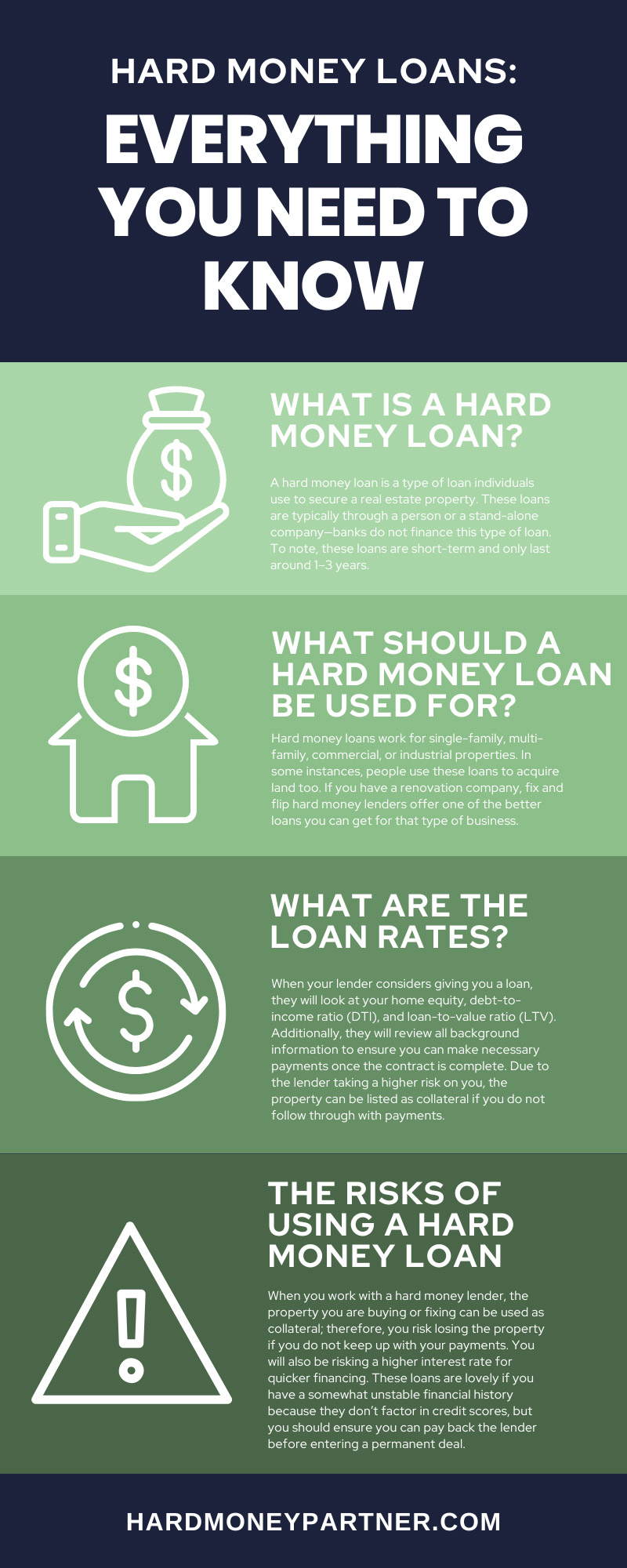

Comprehending Hard Money Financings

Among the defining features of hard money loans is their dependence on the value of the home as opposed to the debtor's creditworthiness. This allows debtors with less-than-perfect debt or those seeking expedited funding to accessibility capital quicker. Additionally, tough cash financings generally include higher interest rates and much shorter payment terms compared to standard loans, mirroring the enhanced risk taken by loan providers.

These fundings offer different purposes, including funding fix-and-flip projects, re-financing distressed buildings, or supplying capital for time-sensitive chances. As such, understanding the subtleties of tough cash fundings is important for capitalists who aim to utilize these economic tools effectively in their property ventures.

Key Aspects to Think About

Following, take into consideration the terms of the lending. Different lenders offer differing rate of interest, costs, and repayment timetables. It is critical to understand these terms completely to prevent any undesirable shocks later on. Additionally, check out the lender's funding speed; a swift authorization process can be important in open markets.

An additional important variable is the lender's experience in your specific market. A loan provider acquainted with neighborhood problems can offer useful insights and might be more adaptable in their underwriting procedure.

How to Assess Lenders

Evaluating hard money lenders entails an organized method to ensure you choose a partner that aligns with your investment goals. A credible lender needs to have a history of effective deals and a solid network of pleased customers.

Following, take a look at the lender's experience and expertise. Various lending institutions might concentrate on numerous sorts of homes, such as property, industrial, or fix-and-flip jobs. Select a lending institution whose know-how matches your financial investment method, as this understanding can dramatically influence the approval process and terms.

Another important aspect is the loan provider's responsiveness and communication design. A trustworthy loan provider ought to be prepared and accessible to answer your questions adequately. Clear interaction during the analysis procedure can suggest exactly how they will certainly handle your funding throughout its period.

Last but not least, make sure that the lending institution is transparent concerning their processes and demands. This consists of a clear understanding of the documentation needed, timelines, and any kind of problems that might use. When choosing a difficult money lender., taking the time to assess these aspects will equip you to make an informed decision.

Contrasting Rates Of Interest and Fees

A complete comparison of interest prices and fees among tough cash lenders is necessary for optimizing your investment returns. Difficult cash loans frequently include higher rates of interest contrasted to standard financing, commonly varying from 7% to 15%. Recognizing these rates will assist you evaluate the prospective expenses connected with your financial investment.

In addition to rates of interest, it is critical to examine the connected fees, which can considerably influence the total click reference financing expense. These fees might consist of origination charges, underwriting costs, and closing costs, usually expressed as a portion of the financing quantity. For example, origination costs can vary from 1% to 3%, and some lending institutions may charge additional costs for handling or administrative tasks.

When contrasting loan providers, think about the complete cost of borrowing, which incorporates both the rate of interest and charges. This all natural strategy will certainly permit you to identify the most affordable options. In addition, be certain to inquire regarding any kind of feasible prepayment penalties, as these can influence your capacity to repay the lending early without incurring extra costs. Eventually, a careful evaluation of rate of interest and fees will cause more informed loaning decisions.

Tips for Effective Loaning

Understanding rate of interest and costs is only component of the formula for protecting a tough cash financing. ga hard money lenders. To ensure successful loaning, it is crucial to extensively assess your financial circumstance and job the possible return on financial investment. When they recognize the desired usage of the funds., Beginning by clearly defining your borrowing purpose; lending institutions are extra most likely to respond positively.

Next, prepare an extensive business plan that describes your project, anticipated timelines, and monetary projections. This shows to loan providers that you have a well-balanced method, enhancing your reliability. Additionally, keeping a solid relationship with your lender can be advantageous; open interaction fosters trust fund and can cause extra desirable terms.

It is likewise necessary to ensure that your building satisfies the lending institution's criteria. Conduct a thorough assessment and give all needed documents to improve the approval procedure. Last but not least, be conscious of exit techniques to settle the lending, as a clear payment strategy guarantees lending institutions of your dedication.

Final Thought

In recap, locating the ideal difficult cash lenders requires a detailed assessment of various elements, including lending institution credibility, finance terms, and specialization in property kinds. Efficient evaluation of loan providers through comparisons of rate of interest and costs, integrated with a clear service plan and strong interaction, improves the probability of positive borrowing experiences. Inevitably, persistent research study and critical involvement with lenders can cause effective financial over here outcomes in realty ventures.

Furthermore, difficult money finances normally come with higher interest rates and shorter payment terms compared to conventional car loans, showing the raised threat taken by lending institutions.

Report this page